Record Keeping Compliance: A Startup’s Guide to Document Retention

Record Keeping Compliance: How Long to Keep Financial and Legal Documents for Your Startup is a critical aspect of running a successful business. Proper document retention ensures you meet legal requirements, manage risk effectively, and maintain a clear financial history.

Navigating the world of startup compliance can feel like traversing a minefield. One crucial, yet often overlooked, aspect is record keeping compliance: how long to keep financial and legal documents for your startup. Are you wondering how long you need to hold onto those tax returns, contracts, and bank statements?

Understanding the required retention periods for different types of documents is essential for avoiding legal issues, streamlining audits, and maintaining accurate financial records. Let’s dive into the details, ensuring your startup remains compliant and organized.

Understanding Record Keeping Compliance for Startups

Record keeping compliance: how long to keep financial and legal documents for your startup is more than just a bureaucratic task; it’s a fundamental part of good business practice. Staying organized and knowing how long to retain certain documents will help you maintain a clear, legal, and audit-ready status.

Why is Record Keeping Compliance Important?

There are several reasons why startups should prioritize record-keeping compliance. Firstly, neglecting to keep proper records can lead to serious legal and financial consequences. Secondly, good record-keeping makes financial audits smoother and more efficient.

- Legal Requirements: Many federal and state laws mandate specific retention periods for financial and legal documents. Non-compliance can result in penalties, fines, and even legal action.

- Audit Readiness: Whether it’s an internal or external audit, having well-organized and easily accessible records streamlines the process, saving time and resources.

- Decision-Making: Accurate and complete records provide a historical perspective, enabling informed business decisions and strategic planning.

Proper record keeping compliance: how long to keep financial and legal documents for your startup not only keeps you out of trouble but also supports your business growth by helping you make better decisions based on past patterns and financial data.

How Long to Keep Financial Documents

One of the most pressing questions for any startup is, “How long do I need to keep my financial documents?” The answer varies depending on the type of document. Here’s a detailed breakdown to guide you.

Tax Returns

The IRS generally recommends keeping tax returns for at least three years from the date you filed or two years from the date you paid the tax, whichever is later, if you file a claim for credit or refund after you filed your return. However, if you did not report income that you should have, and it’s more than 25% of the gross income shown on your return, the IRS gets six years to assess the tax. It’s prudent to keep your tax records for at least six years to cover most situations.

For payroll tax records, keep them for at least four years after the date that the tax becomes due or is paid, whichever is later. Keeping these tax records secure and accessible is a critical element of record keeping compliance: how long to keep financial and legal documents for your startup.

Bank Statements and Credit Card Statements

Bank statements and credit card statements are crucial for reconciling accounts and tracking expenses. Keeping these documents helps you understand your cash flow and identify any discrepancies. These are suggested to be kept for at least three years. These records are essential for record keeping compliance: how long to keep financial and legal documents for your startup.

Invoices and Receipts

Invoices and receipts document your income and expenses. Keep these documents for at least three years, especially if they support deductions claimed on your tax return. For significant purchases or sales, consider keeping the records for the life of the asset, as they may be needed for calculating capital gains or losses later on.

Legal Document Retention Guidelines

Legal documents play a pivotal role in defining the operational framework and compliance adherence of your startup. Retaining these documents for the appropriate duration is not only a legal necessity but also a strategic advantage in protecting your business interests.

Contracts and Agreements

Contracts and agreements define the terms of your business relationships with clients, vendors, and employees. These documents are essential for resolving disputes and enforcing obligations. A good rule of thumb is to keep contracts for the duration of the agreement plus an additional three to seven years after the contract expires.

Corporate Records

Corporate records, such as articles of incorporation, bylaws, and meeting minutes, are fundamental to your company’s legal existence and governance. These documents should be kept permanently. These records serve as the foundation for your firm’s structure, safeguarding your firm in the event of legal problems and preserving proper record keeping compliance: how long to keep financial and legal documents for your startup.

Intellectual Property (IP) Documentation

Documentation pertaining to trademarks, copyrights, and patents is crucial for protecting your startup’s unique creations. Keep all IP-related documents permanently. The value and legal protection afforded by intellectual property necessitate meticulous and enduring safekeeping of these records for robust record keeping compliance: how long to keep financial and legal documents for your startup.

Best Practices for Digital Record Keeping

In today’s digital age, efficient and secure digital record keeping is essential for startups. Adopting the right digital practices can save time, reduce costs, and improve compliance.

Choosing the Right Software

Select software that offers secure storage, easy accessibility, and robust search capabilities. Cloud-based solutions often provide these features, along with automatic backups and version control. When dealing with sensitive information, make sure the software complies with relevant data protection regulations, such as GDPR or CCPA.

To guarantee proper record keeping compliance: how long to keep financial and legal documents for your startup, the software should also provide the ability to set retention policies and automatically delete documents when they are no longer needed. This helps prevent data overload and minimizes the risk of retaining information longer than required.

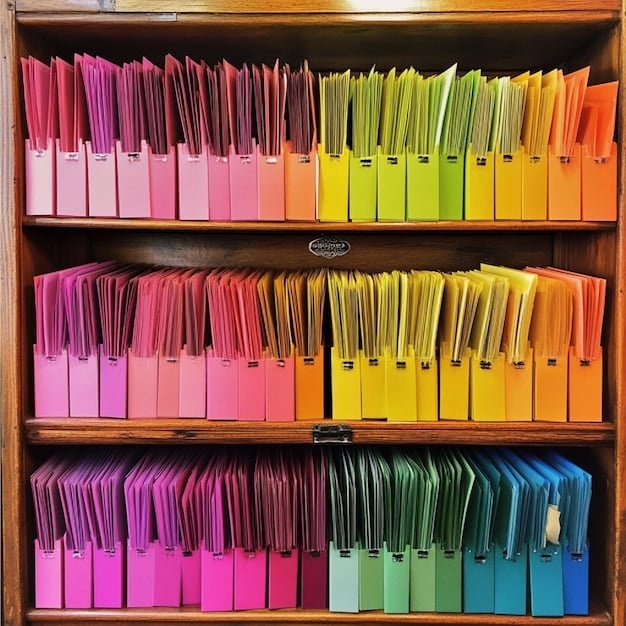

Implementing a Document Management System (DMS)

A Document Management System (DMS) is a software solution that helps you organize, store, and manage your documents electronically. A DMS can significantly improve your record-keeping practices by creating a centralized repository for all your documents. The software also usually provides version control, so you always have access to the most recent version of a document.

Key features of implementing a Document Management System (DMS) include:

- Centralized Storage: Storing all documents in a single, secure location makes it easier to find them when needed.

- Version Control: DMS tracks changes to documents, so you can always revert to an earlier version if necessary.

- Security: Access controls and encryption protect your documents from unauthorized access.

Risks of Non-Compliance

Failing to adhere to record keeping compliance: how long to keep financial and legal documents for your startup can expose your business to significant risks. These risks include penalties, legal action, and reputational damage.

Financial Penalties and Fines

Government agencies, such as the IRS, impose penalties for failing to maintain accurate records or for not retaining documents for the required period. These penalties can be substantial, especially for repeated offenses.

Legal Action

Incomplete or inaccurate records can weaken your defense in legal disputes. If you’re unable to produce necessary documentation, you may face adverse judgments, settlements, or other costly legal consequences.

Reputational Damage

Non-compliance can harm your startup’s reputation. Customers, investors, and partners may lose confidence in your business if they perceive you as being careless with your financial or legal obligations. Maintaining strong record keeping compliance: how long to keep financial and legal documents for your startup can prevent such damage.

Regular Audits and Reviews

To ensure ongoing compliance, conduct regular audits and reviews of your record-keeping practices. These reviews can help identify gaps in your documentation and ensure that your retention policies remain aligned with current laws and regulations.

Internal Audits

Internal audits involve reviewing your records and processes to ensure they meet your company’s internal standards. These audits can be conducted by employees or consultants. They help you catch errors early and improve your overall compliance.

External Audits

External audits are conducted by independent third parties, such as certified public accountants. These audits provide an objective assessment of your record-keeping practices and can help you identify areas for improvement. They offer validation to stakeholders that your company’s records are accurate and reliable.

| Key Point | Brief Description |

|---|---|

| 📝 Tax Returns | Keep for at least three years from filing. |

| 💼 Legal Contracts | Retain during the contract’s term, plus 3-7 years after. |

| 🏢 Corporate Records | Keep permanently, including articles of incorporation. |

| 🔒 Intellectual Property | Maintain documentation for trademarks and patents indefinitely. |

Frequently Asked Questions

Record keeping compliance: how long to keep financial and legal documents for your startup is crucial to avoid legal penalties and ensure smooth audits. It also helps in making informed business choices.

Generally, keep tax returns for at least three years from the date you filed or two years from the date you paid the tax, whichever is later. It is best to keep records for six years.

Use secure, cloud-based storage solutions with encryption and access controls. Regularly back up your data and ensure compliance with data protection regulations for the secure record keeping compliance: how long to keep financial and legal documents for your startup.

Corporate minutes document important decisions made during board meetings. These records should be kept permanently as they provide a historical record of the company’s governance.

Yes, in many cases. However, ensure your digital copies are accurate and complete. For critical legal documents, it’s often best to retain both the original and digital versions to ensure record keeping compliance: how long to keep financial and legal documents for your startup.

Conclusion

Mastering record keeping compliance: how long to keep financial and legal documents for your startup is an ongoing journey, but with the right knowledge and systems, you can ensure your startup remains compliant, organized, and ready for success. By understanding the retention periods for various documents and implementing best practices for digital storage, you’ll be well-prepared to handle audits, legal challenges, and strategic decision-making.