Maximize Your Business Loan Approval Chances in 2025

Maximizing your chances of getting approved for a business loan in 2025 involves understanding lender requirements, improving your credit score, preparing detailed financial statements, and demonstrating a solid business plan with realistic projections.

Are you dreaming of expanding your business, launching a new product, or simply need a financial boost? Securing a business loan can be a game-changer. This article provides actionable strategies on how to maximize your chances of getting approved for a business loan in 2025.

Understand Lender Requirements

Before you even begin the application process, it’s crucial to understand what lenders are looking for. Each lender has specific criteria, and aligning your application with their requirements significantly increases your approval odds.

Lenders evaluate several factors to determine your creditworthiness and the viability of your business. Understanding these factors allows you to prepare adequately and present your business in the best possible light.

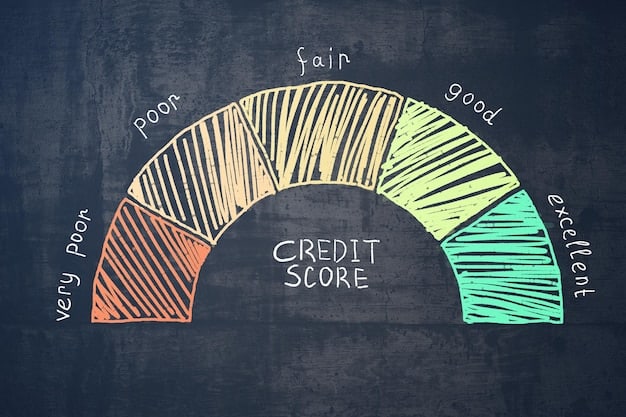

Credit Score Matters

Your credit score is a primary factor in loan approval. A higher credit score indicates a lower risk to the lender. It’s vital to maintain a good personal and business credit score.

Financial Statements and Business Plan

Lenders require detailed financial statements to assess your business’s financial health. A well-structured business plan that outlines your strategy, market analysis, and financial projections is essential.

Here are some key aspects lenders typically consider:

- Credit History: Both your personal and business credit history are reviewed.

- Cash Flow: Lenders want to see consistent cash flow to ensure you can repay the loan.

- Collateral: Assets that can be used as security for the loan.

- Industry: Some industries are considered higher risk than others.

By ensuring you meet these criteria, you position yourself as a credible and reliable borrower, boosting your chances of approval. Focus on addressing any weak points before submitting your application.

Improve Your Credit Score

A strong credit score is the cornerstone of a successful loan application. Lenders use your credit score to gauge your ability to repay debts. Therefore, improving your credit score is a critical step.

Taking proactive steps to enhance your creditworthiness demonstrates responsibility and increases lenders’ confidence in your ability to manage and repay the loan.

Check Your Credit Report

Start by reviewing your credit report for any errors or discrepancies. Correcting inaccuracies can quickly improve your score.

Pay Bills on Time

Payment history is a significant factor in your credit score. Ensure all bills are paid on time to avoid negative marks.

Strategies to improve your credit score include:

- Reducing Credit Utilization: Keep your credit card balances low.

- Diversifying Credit Mix: Having a mix of credit accounts can boost your score.

- Avoiding New Credit Applications: Too many applications can lower your score.

Focusing on these aspects can significantly boost your credit score, making you a more attractive candidate for business loans. Remember that building credit takes time, so start early.

Prepare Detailed Financial Statements

Lenders require comprehensive financial statements to evaluate your business’s stability and profitability. Accurate and well-organized financial documents build trust and credibility.

Preparing these statements meticulously demonstrates your understanding of your business’s financial health and your ability to manage finances responsibly.

Profit and Loss Statement

Also known as an income statement, this shows your revenue, expenses, and profit over a specific period.

Balance Sheet

This provides a snapshot of your assets, liabilities, and equity at a specific point in time.

Cash Flow Statement

This tracks the movement of cash both into and out of your business, revealing your ability to meet short-term obligations.

Key components of strong financial statements include:

- Accuracy: Ensure all numbers are correct and verifiable.

- Consistency: Use consistent accounting methods.

- Clarity: Present information in an easy-to-understand format.

By providing detailed and accurate financial statements, you give lenders confidence in your business’s financial standing. Consider working with an accountant to ensure your statements are professionally prepared.

Craft a Solid Business Plan

A well-crafted business plan is your roadmap to success and a key component of your loan application. It communicates your vision, strategy, and financial projections to potential lenders.

A comprehensive business plan demonstrates your understanding of the market, your business model, and your ability to execute your plans, thereby reducing the lender’s perceived risk.

Executive Summary

This is a brief overview of your business, its mission, and its goals.

Market Analysis

Detailed research on your target market, competition, and industry trends.

Management Team

Information about your team’s experience, skills, and qualifications.

Your business plan should include:

- Clear Objectives: Define your business goals and how you plan to achieve them.

- Realistic Projections: Provide financial forecasts based on sound assumptions.

- Marketing Strategy: Outline how you plan to reach and retain customers.

A compelling business plan not only demonstrates your vision but also illustrates your commitment to success. Highlight your competitive advantages and how you plan to overcome challenges.

Demonstrate Strong Management

Lenders look for capable and experienced management teams. Demonstrate your leadership skills and your team’s expertise to build confidence in your ability to run the business successfully.

A strong management team inspires confidence and assures lenders that the loan will be used effectively and repaid on time.

Experience and Expertise

Highlight your management team’s relevant experience and expertise in the industry.

Organizational Structure

Clearly define roles and responsibilities within the management team.

Key aspects of a strong management team include:

- Proven Track Record: Show previous successes and accomplishments.

- Complementary Skills: Ensure your team has a diverse set of skills.

- Strategic Vision: Demonstrate a clear understanding of your business’s direction.

Showcasing your team’s ability to navigate challenges and capitalize on opportunities can significantly enhance your loan application. Be prepared to answer questions about your management practices.

Explore Different Loan Options

Not all business loans are created equal. Exploring different loan options can help you find the best fit for your business’s needs and circumstances. Consider various types of loans and lending institutions.

Understanding the nuances of each loan type allows you to make an informed decision and choose the option that aligns with your financial goals and risk tolerance.

SBA Loans

Government-backed loans with favorable terms and interest rates.

Term Loans

Loans with a fixed interest rate and repayment schedule.

Lines of Credit

Flexible financing options that allow you to borrow funds as needed.

When exploring loan options, consider:

- Interest Rates: Compare interest rates from different lenders.

- Repayment Terms: Choose a repayment schedule that fits your cash flow.

- Fees: Be aware of any fees associated with the loan.

Taking the time to research and compare different loan options can save you money in the long run and ensure you choose the best financing solution for your business. Don’t hesitate to seek advice from financial advisors.

| Key Aspect | Brief Description |

|---|---|

| 📊 Credit Score | Maintain a good personal and business credit score. |

| 💼 Business Plan | Develop a detailed business plan outlining your strategy. |

| 📑 Financials | Prepare accurate financial statements, including P&L, balance sheet, and cash flow. |

| 🤝 Management | Showcase a strong and experienced management team. |

Frequently Asked Questions (FAQ)

▼

Generally, a credit score of 680 or higher is recommended for a good chance of approval. However, some lenders may consider lower scores depending on other factors.

▼

Interest rates vary widely depending on the lender, loan type, and your creditworthiness. SBA loans often have lower rates, while online lenders might have higher ones.

▼

The approval process can take anywhere from a few days to several weeks. SBA loans typically take longer due to their more rigorous requirements.

▼

Collateral is an asset you pledge to the lender as security for the loan. It reduces the lender’s risk and can improve your chances of approval and potentially lower interest rates.

▼

It is challenging but possible. You’ll need a strong business plan, good credit, and possibly collateral. Some lenders specialize in startup funding.

Conclusion

Securing a business loan in 2025 requires careful preparation and a thorough understanding of lender requirements. By focusing on improving your credit score, preparing detailed financial statements, crafting a solid business plan, and demonstrating strong management, you can significantly increase your chances of getting approved and achieving your business goals.