How Updated SEC Crowdfunding Rules Impact US Seed Funding in 2025

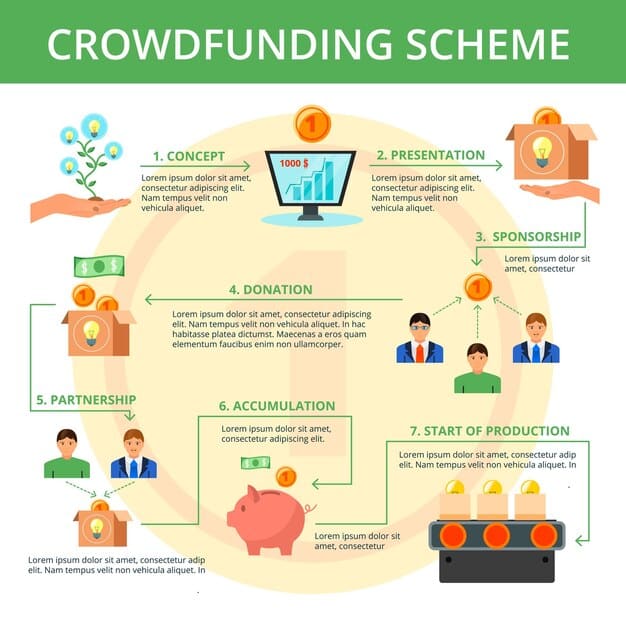

The updated SEC crowdfunding rules, particularly through Regulation Crowdfunding, are anticipated to significantly expand access to capital for US startups seeking seed funding by increasing investment limits and streamlining compliance for 2025.

The landscape of startup funding is continually evolving, and a crucial development for those navigating early-stage capital raising in the United States concerns How Will the Updated SEC Crowdfunding Rules Affect Seed Funding for US Startups in 2025? As we approach 2025, understanding these regulatory shifts becomes paramount for entrepreneurs and investors alike.

Understanding the Regulatory Shift in Crowdfunding

The Securities and Exchange Commission (SEC) has consistently sought to balance investor protection with capital formation, particularly for small businesses and startups. The recent amendments to Regulation Crowdfunding (Reg CF), which officially took effect in March 2021, represent a significant effort to enhance the ability of startups to raise capital from a broad base of investors. These changes, while already implemented, will continue to shape the seed funding environment as we move into 2025 and beyond, allowing the market to fully absorb and adapt to the increased thresholds and simplified processes.

A primary driver behind these updates was the recognition that the previous Reg CF limits were too restrictive for many growing startups. The landscape of early-stage investment had matured, but the regulatory framework hadn’t fully kept pace. These modifications aim to mitigate some of the administrative and financial burdens historically associated with public fundraising for nascent companies, thereby democratizing access to capital beyond traditional venture capitalists and angel investors. The goal is to stimulate innovation and job creation by enabling more direct investment opportunities for the general public, fostering a more inclusive financial ecosystem.

Key Amendments and Their Immediate Impact

The core of the SEC’s changes to Reg CF revolves around several critical adjustments designed to make crowdfunding more viable for seed-stage companies. These changes significantly increase the amount of capital an issuer can raise and provide greater flexibility in communication.

* Increased Offering Limits: The most impactful change is the increased maximum amount that can be raised through Reg CF in a 12-month period. This allows startups to pursue more substantial seed rounds without needing to transition to more complex fundraising avenues too early.

* Investment Limits for Investors: The previous tiered investment limits for non-accredited investors were also adjusted, providing them with more flexibility to invest in opportunities they believe in, while still maintaining important investor protections.

* Test-the-Waters Provisions: Prior to filing, companies can now “test the waters” and gauge investor interest, allowing them to assess market receptivity before incurring significant legal and accounting expenses. This reduces risk for founders and promotes more efficient capital allocation.

These amendments aim to provide a more robust framework for seed funding. By enabling companies to raise larger amounts and simplifying the initial outreach phase, the SEC hopes to inject more liquidity into the early-stage market, making it easier for pioneering ideas to find the necessary financial support. This regulatory evolution reflects a commitment to nurturing the entrepreneurial spirit within the US economy.

Expanding the Horizon for Seed Funding

The updated SEC crowdfunding rules are poised to significantly expand the horizon for seed funding, offering US startups unprecedented access to capital. By raising the maximum amount that can be sought through Regulation Crowdfunding (Reg CF), a broader spectrum of companies can now consider this pathway for their initial capital injection. This shift directly addresses a critical gap in the funding lifecycle, where traditional methods often prove inaccessible or too cumbersome for nascent ventures. The enhanced limits and flexible rules mean that a startup needing, for instance, $3 million for initial product development and market entry, can potentially secure that entire amount through crowdfunding, rather than piecing together smaller rounds or resorting to more dilutive options.

This expanded access is not merely about larger sums; it also broadens the potential investor base. Previously, stricter limits might have made crowdfunding less appealing to investors seeking significant returns, as the total pool of available capital was limited. Now, with higher caps, more sophisticated individual investors and even smaller institutional players might find Reg CF offerings more attractive. This democratizes investment, allowing everyday citizens to participate in the growth of innovative companies, fostering a stronger connection between communities and the businesses that serve them. The increased visibility and accessibility could lead to a more dynamic and competitive seed funding market, where promising ideas, regardless of their founders’ traditional networks, have a better chance of securing the necessary capital to thrive.

Impact on Startup Formation and Demographics

The ripple effect of these rule changes extends beyond just capital raised; they could profoundly influence who gets to start a company and what types of companies get funded. Historically, access to seed funding has been heavily concentrated in specific geographical areas and networks, often excluding diverse founders and underserved communities.

* Greater Inclusivity: Crowdfunding, by its nature, is more accessible. Lower barriers to entry for issuers mean that founders without traditional Silicon Valley connections or elite educational backgrounds can still present their ideas directly to a global audience of potential investors. This promotes a more equitable distribution of startup opportunities.

* Regional Development: Startups outside major tech hubs often struggle to attract early-stage venture capital. Crowdfunding platforms can serve as vital conduits for these regional companies to connect with investors, fostering innovation and economic growth in diverse locales across the US.

* Sector Diversification: Certain industries, like deep tech, hardware, or social enterprises, may be less appealing to traditional VCs due to longer timelines or lower perceived returns. Crowdfunding allows these specialized ventures to find niche investors who are passionate about their mission and willing to support long-term development.

Ultimately, these regulatory updates are positioned to encourage a more diverse and resilient startup ecosystem, giving rise to new ideas and businesses that might otherwise struggle to launch within conventional funding structures. The ability to appeal directly to a wide array of backers fosters not just financial support, but also a network of evangelists for the startup’s mission.

Shifting Dynamics in Investor Participation

The updated SEC crowdfunding rules are not just reshaping how startups raise capital; they are fundamentally altering the dynamics of investor participation in seed funding. With increased investment limits and simplified processes, a broader spectrum of investors, including both accredited and non-accredited individuals, are finding it easier and more appealing to engage with early-stage companies. This shift moves beyond the traditional venture capital model, where a select few institutions and high-net-worth individuals dominated the seed stage. Now, the common investor can play a more significant role, directly supporting innovation and potentially benefiting from the growth of promising new ventures.

One of the most noticeable changes is the potential for a larger volume of smaller investments to collectively form substantial seed rounds. This “power in numbers” approach means that a startup doesn’t need to secure a few large checks from institutional investors; instead, it can raise millions from thousands of individuals, each contributing a manageable sum. This distributed investment model also means that startups gain more than just capital; they acquire a passionate base of micro-investors who often become early advocates and customers for their products or services. This symbiotic relationship can provide critical early momentum and market feedback that is invaluable to a fledgling business, distinguishing it from companies funded through more traditional, less engaged, investment channels.

Accredited vs. Non-Accredited Investor Engagement

The rule changes specifically address aspects that impact both accredited and non-accredited investors, aiming to balance accessibility with protection.

* Non-Accredited Investor Empowerment: The adjustments to investment limits for non-accredited investors provide them with greater flexibility to participate. While caps still exist to mitigate risk, the expanded thresholds allow for more substantial, yet still diversified, engagement in startup opportunities. This means more ordinary citizens can invest in projects they believe in.

* Accredited Investor Streamlining: Although accredited investors have fewer restrictions, the simplified overall process and increased offering limits under Reg CF make it a more attractive option for them as well. They might leverage crowdfunding platforms for deal flow or to invest alongside a larger community, seeing it as an efficient avenue for diversification or early validation of market interest.

* Due Diligence and Disclosure: To protect this broader investor base, the SEC maintains strict requirements for financial disclosures and ongoing reporting for companies raising capital through Reg CF. This transparency is crucial for investors—especially non-accredited ones—to make informed decisions.

The aggregate effect is a more diverse, engaged, and potentially larger pool of early-stage capital. This diversification reduces reliance on any single investor type, creating a more robust and resilient funding ecosystem for US startups, where the collective might of many smaller investors can rival the impact of traditional large-scale investments.

Compliance and Operational Considerations for Startups

While the updated SEC crowdfunding rules present significant opportunities for seed funding, startups must navigate various compliance and operational considerations to effectively leverage this fundraising channel by 2025. The increased offering limits do not negate the regulatory obligations; rather, they scale them up, requiring companies to be even more diligent in their preparation and execution. A critical aspect involves adhering to the enhanced disclosure requirements mandated by the SEC, which demand transparent and accurate reporting of financial health, business operations, and future projections. Companies must be prepared to invest in professional assistance for legal, accounting, and marketing services to ensure full compliance and present a compelling case to potential investors. This preparation is essential to inspire investor confidence and avoid legal pitfalls.

Beyond the initial offering, startups undertaking crowdfunding are subject to ongoing reporting requirements. This includes filing annual reports with the SEC, which detail financial performance, material events, and other pertinent information. While less onerous than public company reporting, it still demands a commitment to transparency and discipline. Furthermore, managing hundreds or even thousands of small investors requires robust investor relations capabilities. Startups need clear communication strategies, efficient dividend distribution mechanisms (if applicable), and a system for addressing investor inquiries. This management can be resource-intensive, and companies must factor these operational overheads into their overall fundraising strategy. Neglecting these post-raise obligations can damage a startup’s reputation and lead to regulatory scrutiny, undermining the benefits of successful crowdfunding.

Technological Integration and Platform Selection

The success of a crowdfunding campaign is heavily reliant on the technology and the platform chosen. These platforms act as intermediaries, connecting issuers with investors and facilitating the fundraising process.

* Platform Features: Startups should meticulously evaluate platforms based on their user experience, investor reach, fee structures, and the range of services offered (e.g., escrow services, investor management tools, marketing support). A platform that aligns with the startup’s specific needs can significantly streamline the fundraising process.

* Data Security and Privacy: Given the sensitive financial information exchanged, ensuring the chosen platform has robust data security protocols and complies with privacy regulations is paramount. Breaches can lead to reputational damage and legal liabilities.

* Post-Campaign Management Tools: Many platforms offer tools for post-campaign investor management, including updates, document sharing, and communication channels. Leveraging these features can substantially reduce the administrative burden associated with managing a large investor base.

Choosing the right platform and seamlessly integrating it into the startup’s operational workflow is as critical as developing a strong pitch. The technology enables the efficiency and broad reach that define modern crowdfunding, transforming what was once a complex, localized process into a global, streamlined fundraising machine.

The Competitive Landscape of Seed Funding in 2025

As we look towards 2025, the updated SEC crowdfunding rules are set to intensify the competitive landscape for seed funding in the United States. With increased limits and streamlined processes, more startups will likely opt for crowdfunding as a viable alternative to traditional venture capital or angel investments. This influx of companies seeking capital through platforms could lead to greater competition for investor attention. Startups will need to differentiate themselves not only through innovative products or services but also through sophisticated marketing campaigns, compelling narratives, and transparent communication, all designed to capture the interest of a diverse investor base. The ability to articulate a clear value proposition and demonstrate scalability will be crucial in a potentially crowded market.

Furthermore, the rise of crowdfunding as a mainstream funding channel might also prompt traditional investors, such as angel groups and smaller venture capital firms, to reassess their own investment strategies. They may begin to view successful crowdfunding campaigns as a form of market validation, effectively using crowdfunding platforms as a pre-screening mechanism for later-stage investments. This dynamic could lead to a hybrid funding environment where early crowdfunding success attracts follow-on traditional capital, bridging the gap between grassroots funding and institutional investment. Conversely, it might also mean that startups that struggle to gain traction on crowdfunding platforms could find it even harder to secure traditional seed funding, as the market signals their lack of perceived appeal.

Evolving Strategies for Startups and Investors

To succeed in this evolving landscape, both startups and investors will need to adapt their strategies.

* For Startups:

* Refined Storytelling: Crafting a compelling and authentic story that resonates with a broad audience will be paramount. Investors, especially non-accredited ones, often invest in the mission and the team as much as the financial projections.

* Community Engagement: Building and engaging a community around the startup before and during the campaign can significantly boost success rates. Early supporters frequently become early investors and advocates.

* Hybrid Funding Models: Many startups may adopt a multi-pronged approach, combining crowdfunding with traditional angel or VC rounds to optimize their capital stack and leverage different investor groups.

* For Investors:

* Enhanced Due Diligence (DIY): While platforms provide disclosures, individual investors may need to sharpen their own due diligence skills to sift through the increasing number of opportunities and identify truly promising ventures.

* Portfolio Diversification: With expanded access, investors can build diversified portfolios of startup investments, spreading risk across multiple early-stage companies.

* Understanding Risk-Reward: Recognizing the inherent risks of early-stage investing remains crucial. The potential for high returns comes with an equally high potential for loss, and investors must approach crowdfunding with a clear understanding of these dynamics.

The competitive landscape in 2025 will reward agility, transparency, and strategic marketing for startups, while offering investors unprecedented choice and direct involvement in the innovation economy. The key will be for both parties to adapt swiftly to the new possibilities and challenges presented by these regulatory updates.

Economic Implications and Future Outlook

The economic implications of the updated SEC crowdfunding rules for seed funding in the US are far-reaching and largely positive as we look ahead to 2025 and beyond. By expanding access to capital for a greater number of startups, these rules are expected to act as a significant catalyst for innovation and job creation. Small businesses and startups are historically major drivers of economic growth, introducing new technologies, products, and services that can transform industries and improve lives. With easier access to crucial early-stage financing, more of these ventures will be able to move from concept to commercialization, contributing directly to the nation’s GDP and fostering a dynamic economic environment.

Furthermore, the democratization of investment through crowdfunding can lead to a more equitable distribution of wealth and opportunity. As more everyday Americans participate in the growth of successful startups, the potential for returns is no longer exclusively concentrated among the wealthy and institutional investors. This broadened participation could foster greater financial inclusion and potentially reduce wealth disparities over time. The increased flow of capital to diverse founders and companies in various regions across the US also means that economic development is not confined to traditional tech hubs, but can be diffused more broadly, creating local economic ecosystems around emerging businesses. This decentralized growth could lead to a more robust and resilient national economy, less susceptible to regional downturns.

Potential Challenges and Regulatory Evolution

Despite the largely optimistic outlook, the future is not without its challenges, and the regulatory framework will likely continue to evolve.

* Investor Protection Concerns: As more non-accredited investors participate, the SEC will remain vigilant regarding investor protection. There may be ongoing discussions about enhancing educational resources for investors or further refining disclosure requirements to ensure they fully understand the risks involved.

* Market Saturation: A significant increase in crowdfunding campaigns could lead to market saturation, making it harder for individual startups to stand out. This might necessitate further innovation in how platforms and companies market their offerings.

* Fraud and Misrepresentation: Despite regulatory oversight, the risk of fraudulent schemes or misrepresentation always exists. The SEC and FINRA will continue to monitor the market, and enforcement actions may shape future interpretations or amendments to the rules.

The success of these rules will depend heavily on market participants adapting ethically and efficiently, and the SEC demonstrating flexibility in response to market developments. The long-term trajectory points towards a more inclusive, dynamic, and potentially more robust seed funding market, continually adapting to the needs of groundbreaking startups and the investing public alike.

| Key Aspect | Impact on Seed Funding |

|---|---|

| 📈 Increased Offering Limits | Startups can raise more capital via Reg CF, reducing reliance on traditional funding and making full seed rounds possible through crowdfunding. |

| 🌎 Broader Investor Base | More non-accredited investors can participate, democratizing investment and providing startups with a larger pool of potential backers. |

| ⚖️ Enhanced Compliance Needs | Startups require robust legal, accounting, and investor relations support for disclosures and ongoing reporting due to increased capital amounts. |

| 💡 Economic & Innovation Boost | Stimulates startup formation, job creation, and economic growth by enabling more ventures to access vital early-stage capital. |

Frequently Asked Questions About SEC Crowdfunding Rules

The primary change is the increased maximum amount that can be raised through Regulation Crowdfunding (Reg CF) in a 12-month period, up to $5 million from the previous $1.07 million. Other key changes include revised investment limits for non-accredited investors and the introduction of “test-the-waters” provisions, allowing companies to gauge interest before incurring significant costs, streamlining the fundraising process.

These updates significantly broaden access to seed capital for US startups. By allowing larger amounts to be raised, companies can now complete entire seed rounds through crowdfunding, reducing reliance on traditional angel investors or venture capitalists. This also opens up funding opportunities for startups in diverse geographic locations and those with untraditional business models, fostering a more inclusive entrepreneurial ecosystem.

Yes, while the rules offer more flexibility, startups must still comply with SEC disclosure requirements. Managing a larger number of small investors also necessitates robust investor relations and ongoing reporting, including annual reports to the SEC. Companies will need to ensure they have adequate legal, accounting, and administrative resources to meet these obligations effectively.

Individual investors, particularly non-accredited ones, will have greater flexibility in how much they can invest in crowdfunding opportunities. While limits still exist, the updated rules provide more avenues for everyday citizens to participate in the growth of early-stage companies. This democratizes investment, but investors must remain diligent in their research and understand the inherent risks of startup investments.

Despite increased limits, startups may face challenges such as intense competition for investor attention and the need for robust marketing to stand out. They also face ongoing compliance burdens and the operational complexity of managing a large investor base. Market saturation and the omnipresent risk of fraud remain concerns, necessitating continuous vigilance from both regulators and participants.

Conclusion

The updated SEC crowdfunding rules represent a pivotal evolution in the landscape of seed funding for US startups, particularly as we look toward 2025. By significantly increasing offering limits and streamlining investor participation, these amendments are poised to democratize access to capital, empower diverse founders, and ignite innovation across various sectors and geographies. While compliance and operational considerations will demand careful attention from startups, the overall trajectory points towards a more robust and inclusive early-stage investment ecosystem. The long-term implications suggest a vibrant future where more inventive ideas can find the crucial financial backing needed to transform into thriving businesses, ultimately contributing to a stronger, more dynamic US economy.