Mitigate Risk: Robust AML Programs for Entrepreneurs

Navigating the intricate landscape of financial compliance, a robust Anti-Money Laundering (AML) program is not merely a regulatory obligation but an essential strategic asset for entrepreneurs to protect their businesses from illicit financial activities and reduce significant legal and reputational risks.

In today’s fast-paced business environment, entrepreneurs face a myriad of challenges, not least among them the complex world of financial regulations. Understanding and implementing a robust Anti-Money Laundering (AML) program is no longer just an option but a critical necessity for mitigating risk and fostering sustainable growth.

Understanding the AML Landscape for Entrepreneurs

The global fight against money laundering and terrorist financing has intensified, leading to a complex web of regulations that businesses must navigate. For entrepreneurs, this landscape can appear daunting, often perceived as a bureaucratic hurdle rather than a protective measure. However, a deep understanding of AML principles transforms compliance from a burden into a strategic advantage, safeguarding assets, reputation, and future opportunities.

At its core, AML aims to prevent criminals from disguising illegally obtained funds as legitimate income. This involves a multi-faceted approach, requiring financial institutions and an increasing number of non-financial businesses to implement controls that detect and report suspicious activities. The scope of AML regulations is continuously expanding, encompassing a broader range of entities and transactions, making it imperative for entrepreneurs across various sectors to be vigilant and proactive.

The regulatory framework in the US, primarily driven by the Bank Secrecy Act (BSA) and overseen by the Financial Crimes Enforcement Network (FinCEN), mandates specific requirements for covered financial institutions. While not every entrepreneur’s business directly falls under the BSA’s strict definition of a financial institution, the ripple effect of these regulations means that compliance considerations often extend indirectly to many businesses. Understanding these foundational elements is the first step toward building a resilient AML strategy tailored to entrepreneurial ventures.

The Evolving Threat of Financial Crime

Financial criminals are constantly innovating their methods, exploiting technological advancements and global interconnectedness. This evolution necessitates a dynamic and adaptive approach to AML. Entrepreneurs, particularly those operating in high-risk sectors or utilizing emerging technologies, are increasingly vulnerable targets. The consequences of failing to detect and prevent money laundering can be severe, ranging from hefty fines and asset forfeiture to irreparable damage to brand reputation and even criminal charges for individuals.

Moreover, the concept of “follow the money” has become a cornerstone of law enforcement investigations. Illicit funds, whether derived from drug trafficking, fraud, corruption, or terrorism, invariably pass through legitimate financial systems at some point. By implementing rigorous AML controls, entrepreneurs contribute to the broader effort of disrupting criminal networks and protecting the integrity of the global financial system.

Key Regulatory Bodies and Their Role

- FinCEN: The Financial Crimes Enforcement Network is the lead agency in the US for administering the BSA, collecting and analyzing financial transaction data to combat domestic and international money laundering.

- Treasury Department: Oversees FinCEN and other agencies involved in financial crime enforcement, setting broad policy directives.

- Federal Banking Agencies (e.g., Federal Reserve, OCC, FDIC): Supervise financial institutions for AML compliance, conducting examinations and enforcing corrective actions.

- State Regulators: Play a crucial role in overseeing state-chartered institutions and certain non-bank financial service providers for AML compliance.

For entrepreneurs, being aware of which regulatory bodies might have jurisdiction over their specific business model is critical for ensuring full compliance and avoiding oversight. This nuanced understanding empowers business owners to proactively address compliance gaps before they become problematic. The interaction between federal and state regulations often adds another layer of complexity, demanding careful consideration and expert guidance where necessary.

Beyond direct regulatory oversight, entrepreneurs must also consider the expectations of their banking partners and other financial intermediaries. These institutions are themselves subject to stringent AML requirements and will often impose their own due diligence standards on their business clients. A strong AML program not only demonstrates the entrepreneur’s commitment to compliance but also facilitates smoother relationships with critical financial service providers, showcasing responsible business practices.

Designing Your Entrepreneurial AML Program

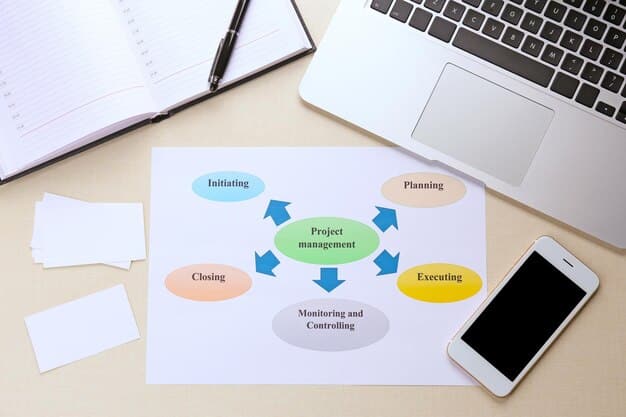

Developing an effective AML program for an entrepreneurial venture requires a tailored approach, recognizing the unique scale, resources, and risk profile of smaller businesses. It’s not about replicating a large corporate compliance framework, but rather implementing proportionate and practical controls that effectively mitigate identified risks. The foundation of any robust AML program rests upon four pillars: internal controls, designated compliance officer, ongoing training, and independent review.

The first step in designing an AML program is a thorough risk assessment. This involves identifying the specific money laundering and terrorist financing risks inherent to your business model, customer base, geographic locations of operation, products, and services. For instance, a business dealing extensively with international transfers or high-value commodities will inherently face different risks than a purely domestic, low-volume service provider. This initial assessment provides the blueprint for allocating resources and structuring controls effectively.

Once risks are identified, internal controls must be established. These are the policies, procedures, and processes designed to prevent money laundering and detect suspicious activities. For an entrepreneur, this might include clear guidelines on customer onboarding, transaction monitoring, record-keeping, and reporting protocols. Simplicity and clarity are key; complex procedures can lead to non-compliance due to misunderstanding or oversight, particularly in a lean operational environment. Documentation of these controls is also crucial for demonstrating compliance to regulators or financial partners.

Key Components of an AML Program

- Written Policies and Procedures: Documenting how the business will comply with AML regulations, including customer identification, transaction monitoring, and reporting.

- Designated Compliance Officer: An individual responsible for overseeing the AML program and ensuring its effective implementation. For small businesses, this might be the entrepreneur themselves, but clarity on duties is essential.

- Employee Training Program: Regular training for all relevant employees on AML concepts, red flags, and reporting procedures to foster a culture of compliance.

- Independent Review: Periodic assessment of the AML program by an independent party to identify weaknesses and ensure ongoing effectiveness. This can be an external auditor or internal personnel with no direct involvement in the AML operations.

Selecting and empowering a designated compliance officer is paramount, even if it’s the owner themselves. This individual must possess sufficient authority and resources to implement and manage the program effectively. Their responsibilities typically include staying abreast of regulatory changes, overseeing risk assessments, developing and updating policies, training staff, and filing suspicious activity reports (SARs) when necessary. For entrepreneurs, this role often needs to be integrated seamlessly into existing operational responsibilities.

Employee training, even for a small team, is non-negotiable. Every employee who interacts with customers or handles financial transactions should receive regular training on AML policies and red flags. This builds a collective defense against financial crime, ensuring that suspicious activities are recognized and reported promptly. Training doesn’t have to be elaborate; it can be integrated into existing onboarding processes and reinforced through periodic refreshers tailored to the specific roles and responsibilities within the business.

Finally, an independent review of the AML program is crucial for its ongoing effectiveness. This review should assess the adequacy of policies and procedures, the effectiveness of internal controls, and the compliance officer’s performance. For small businesses, an independent review might not be a full-scale audit but rather a comprehensive self-assessment by someone not directly involved in the program’s day-to-day operations, or a review by a qualified third-party consultant. The goal is continuous improvement and adaptation to new risks and regulatory requirements, ensuring the program remains robust and relevant.

Implementing Customer Due Diligence (CDD)

The cornerstone of any effective Anti-Money Laundering (AML) program is robust Customer Due Diligence (CDD). This process involves verifying the identity of your customers and understanding the nature of their business to assess the risk of money laundering or terrorist financing. For entrepreneurs, CDD is not just about ticking a box; it’s about knowing who you’re doing business with, a principle vital for both compliance and sound business judgment. The depth of CDD should be commensurate with the perceived risk associated with the customer and the transaction.

At a minimum, CDD requires collecting and verifying basic identifying information from customers before establishing a business relationship. This often includes names, addresses, dates of birth, and identification numbers for individuals, and for entities, details such as legal name, address, taxpayer identification number, and beneficial ownership information. The “know your customer” (KYC) imperative drives this process, ensuring that the business is not unwittingly facilitating illicit activities.

Beyond basic identification, CDD also involves understanding the purpose and intended nature of the business relationship. This allows entrepreneurs to identify unusual or suspicious patterns of activity that deviate from a customer’s typical profile. For example, a customer whose stated purpose is to purchase small consumer goods suddenly engaging in large, inexplicable international transactions would warrant further scrutiny. Proactive collection of this information allows for better real-time monitoring and anomaly detection.

Enhanced Due Diligence (EDD) for High-Risk Customers

Not all customers present the same level of risk. For those identified as high-risk – such as Politically Exposed Persons (PEPs), customers from high-risk jurisdictions, or those involved in high-risk industries – Enhanced Due Diligence (EDD) is required. EDD involves taking additional measures to verify identity and understand the source of funds or wealth.

EDD measures may include:

- Obtaining additional identifying information.

- Verifying the source of income or wealth.

- Conducting more frequent and intensive transaction monitoring.

- Requiring approval from senior management for high-risk accounts.

- Exploring the rationale behind complex or unusual transaction structures.

The determination of when to apply EDD is a critical component of a risk-based approach to AML. Entrepreneurs must develop clear criteria and procedures for identifying high-risk customers during the onboarding process and throughout the business relationship. This ensures that resources are appropriately allocated to areas of greatest vulnerability, maximizing the effectiveness of the AML program without unduly burdening lower-risk operations. The aim is to create a dynamic system that adapts to changing customer behavior and external risk factors.

Maintaining accurate and up-to-date customer information is also an ongoing responsibility. Life circumstances change, business operations evolve, and risk profiles can shift over time. Periodic reviews of customer relationships ensure that the initial risk assessment remains valid and that any new red flags are identified promptly. For entrepreneurs, embracing technology, such as automated identity verification tools and CRM systems that flag discrepancies, can significantly streamline the CDD and EDD processes, making compliance more efficient and effective. This proactive management of customer data is essential to a robust and compliant AML framework.

Effective Transaction Monitoring and Reporting

Once customer due diligence establishes a baseline, the next critical component of a robust Anti-Money Laundering (AML) program for entrepreneurs is effective transaction monitoring. This ongoing process involves scrutinizing financial transactions for unusual patterns or suspicious activities that might indicate money laundering or terrorist financing. It’s the active surveillance limb of the AML framework, ensuring that even legitimate customers don’t engage in illicit financial behavior once a relationship is established.

Transaction monitoring should be designed to identify “red flags” – specific types of transactions or behaviors that are commonly associated with financial crime. These can include large, unexplained cash transactions, frequent transfers to or from high-risk jurisdictions, rapid movement of funds between multiple accounts without clear business rationale, or transactions that are inconsistent with the customer’s known business activities or risk profile. The effectiveness of monitoring hinges on the ability to distinguish between legitimate business operations and potentially suspicious ones, a skill honed through experience and continuous training.

For entrepreneurs, implementing transaction monitoring may not require sophisticated software solutions initially. It can begin with a manual review of larger or unusual transactions, coupled with a deep understanding of your customers and their typical financial habits. As the business grows, investing in automated monitoring tools can become increasingly beneficial, allowing for the processing of higher volumes of transactions and the identification of more complex patterns that might otherwise be missed. The key is to establish thresholds and criteria that trigger further investigation, ensuring a systematic approach to identifying anomalies.

Responding to Red Flags and Filing SARs

When a transaction or pattern of activity triggers a red flag, the next step is a thorough investigation. This involves gathering additional information, reviewing customer records, and, if necessary, engaging directly with the customer to seek clarification. The goal is to determine if the suspicious activity can be explained by legitimate business reasons or if it appears to be indicative of illicit behavior. Maintaining detailed records of these investigations, including the rationale for deeming an activity suspicious or legitimate, is crucial for audit trails and compliance.

If, after investigation, the business determines that a transaction or activity is suspicious and potentially linked to money laundering or terrorist financing, a Suspicious Activity Report (SAR) must be filed with FinCEN. This reporting obligation is central to the AML framework, as it provides law enforcement with crucial intelligence to investigate financial crimes. SARs are confidential documents, and the fact that a SAR has been filed must not be disclosed to the customer or any unauthorized parties, a concept known as “tipping off.”

Common red flags that necessitate further investigation and potentially a SAR include:

- Unusual or unexplained large cash deposits or withdrawals.

- Complex or convoluted transactions without apparent economic purpose.

- Customer exhibiting unusual secrecy or evasiveness about transactions.

- Transactions inconsistent with the customer’s known business or personal profile.

- Attempts to avoid currency reporting requirements (e.g., structuring transactions).

The decision to file a SAR requires careful judgment and a clear understanding of the reporting thresholds and definitions. FinCEN provides guidance and specific forms for SAR filings, which must be completed accurately and in a timely manner. For entrepreneurs, having a clear internal protocol for SAR decision-making and filing is essential. This often involves the designated AML compliance officer reviewing all potential SARs and ensuring that all necessary information is included. Timeliness is critical; SARs typically need to be filed within 30 days of the initial detection of suspicious activity. Proactive training and clear internal guidelines are paramount to ensure these obligations are met consistently and effectively.

Risk Assessment and Management for Entrepreneurs

A continuous and adaptive risk assessment and management process is the bedrock of a dynamic and effective Anti-Money Laundering (AML) program for entrepreneurs. While an initial risk assessment provides the foundation, sustained compliance requires a constant re-evaluation of evolving threats, vulnerabilities, and changes within the business’s operations. This proactive approach ensures that AML controls remain proportionate to the risks faced and that resources are allocated efficiently.

For entrepreneurs, risk assessment should not be a static exercise, but rather an integral part of strategic planning. Factors that can influence a business’s AML risk profile include:

- Customer Types: Are you onboarding high-risk customers, such as cash-intensive businesses, NGOs operating in volatile regions, or shell corporations?

- Products & Services: Do you offer services that are inherently vulnerable to money laundering, such as international wire transfers, crypto-assets, or high-value physical goods?

- Geographic Presence: Do you operate in or deal with customers from countries identified as high-risk for money laundering or terrorism financing?

- Delivery Channels: Are your services predominantly online, over the counter, or through intermediaries, each presenting different risk vectors?

Regularly reviewing these factors allows entrepreneurs to identify emerging risks and adapt their AML controls accordingly. For a business that initially operated solely domestically and then expands internationally, for instance, a reassessment of geographic risk and associated due diligence processes would be immediately necessary. Similarly, the introduction of a new product or service, like accepting cryptocurrency payments, would necessitate an evaluation of the new money laundering vectors it might introduce.

Mitigating Identified Risks

Once risks are identified, the next step is to implement controls that effectively mitigate them. This isn’t just about adhering to regulations, but about building resilience into the business model. Mitigation strategies can range from enhancing customer due diligence for specific customer segments, implementing stricter transaction monitoring thresholds for high-risk product lines, or imposing internal restrictions on certain types of transactions altogether. The choice of mitigation depends on the nature and severity of the identified risk.

For example, if an entrepreneur’s business identifies a high risk associated with a particular geographic region, mitigation might involve:

- Requiring enhanced due diligence for all customers from that region.

- Implementing stricter identity verification procedures, possibly demanding multiple forms of official identification.

- Imposing lower transaction limits for outbound transfers to that region, or requiring senior management approval for such transactions.

- Increased scrutiny of the source of funds and wealth for customers originating from or extensively dealing with that region.

The principle of proportionality is key here: the depth and complexity of risk mitigation measures should align with the level of risk. An entrepreneur with limited resources should focus on addressing the most significant risks first, rather than attempting to implement overly burdensome controls for every conceivable low-probability threat. This pragmatic approach ensures that compliance efforts are both effective and sustainable for a growing business, integrating seamlessly into operational workflows rather than becoming a separate, cumbersome department.

Documentation of the risk assessment process and the rationale behind specific mitigation strategies is also vital. This demonstrates to regulators, auditors, and banking partners that the entrepreneur has taken a thoughtful, risk-based approach to AML compliance. A well-documented process not only supports regulatory obligations but also serves as a valuable internal tool for ongoing management and future planning, allowing for continuous refinement of the company’s AML posture against evolving financial crime threats.

Training and Independent Review for Ongoing Compliance

While establishing robust policies, customer due diligence, and transaction monitoring forms the core of an Anti-Money Laundering (AML) program, its long-term effectiveness hinges on two crucial elements: continuous training and periodic independent review. For entrepreneurs, neglecting these aspects can undermine even the most well-designed initial program, leaving the business vulnerable to compliance failures and financial crime risks. Compliance is not a one-time event; it’s an ongoing commitment that requires continuous learning and adaptation.

Employee training is paramount. Every team member, from the front-line staff interacting with customers to those in back-office operations, plays a role in AML compliance. Their active participation and understanding are essential to catch red flags and implement procedures effectively. Training should not be a static, annual ritual but an evolving process that reflects new regulations, emerging money laundering typologies, and lessons learned from internal incidents or industry trends. For entrepreneurs running lean operations, this training can be integrated into regular team meetings, through digestible online modules, or even by sharing relevant news articles or case studies.

Key topics for AML training should include:

- The importance of AML compliance and its impact on the business and broader society.

- Specific policies and procedures of the business’s AML program.

- How to identify and report suspicious activities and red flags relevant to their role.

- The latest money laundering schemes and techniques (typologies).

- The consequences of non-compliance for both the business and individuals.

Tailored training ensures that the information is relevant and actionable for each employee, fostering a culture of vigilance. It also empowers staff to be the first line of defense against financial crime, making them active participants rather than passive recipients of instructions. Regular refreshers and scenario-based exercises can enhance retention and application of the learned material, building confidence in employees’ ability to identify and respond to suspicious behavior effectively.

The Importance of Independent Review

The second critical element is an independent review of the AML program. This serves as an objective external or internal check on the program’s adequacy and effectiveness. An independent review helps identify weaknesses, inefficiencies, and areas of non-compliance that might be overlooked by those directly involved in the program’s day-to-day operation. For entrepreneurs, this often means engaging an external consultant or auditor specializing in AML compliance, or, if feasible, designating an internal individual with no direct involvement in the AML program to conduct the review. The independence of the reviewer is key to obtaining an unbiased assessment.

An independent review typically assesses:

- The comprehensiveness and clarity of the written AML policies and procedures.

- The effectiveness of internal controls, including customer due diligence and transaction monitoring systems.

- The adequacy and frequency of employee training.

- The performance of the designated AML compliance officer.

- Compliance with applicable laws and regulations.

- The overall effectiveness of the program in identifying and mitigating money laundering risks.

The findings of the independent review should lead to concrete action plans for remediation. It’s not enough to simply identify deficiencies; they must be addressed in a timely manner. This continuous feedback loop ensures that the AML program remains dynamic, adapting to internal changes and external threats. For entrepreneurs, the investment in independent review, while seemingly an additional cost, is a vital safeguard against much larger potential fines, reputational damage, and legal liabilities. It demonstrates a commitment to robust compliance and strengthens the business’s overall risk management framework, building confidence among stakeholders and regulators alike.

Technological Solutions and Future Trends in AML

The evolving landscape of financial crime demands that Anti-Money Laundering (AML) programs embrace technological solutions. For entrepreneurs, leveraging technology can significantly enhance the efficiency and effectiveness of their AML efforts, especially as their operations scale and the volume of transactions increases. While manual processes might suffice for very small businesses initially, automation becomes crucial for comprehensive monitoring, data analysis, and compliance management as complexity grows. Technology is not merely a tool for compliance; it’s a strategic asset that can transform AML from a reactive burden into a proactive defense.

One of the most impactful technological advancements for AML is the use of Artificial Intelligence (AI) and Machine Learning (ML). These technologies can process vast amounts of transaction data, identify complex patterns that human analysts might miss, and flag suspicious activities with greater precision. AI-powered systems can also reduce false positives, allowing compliance teams to focus on truly high-risk alerts rather than sifting through numerous benign ones. For entrepreneurs, this means more efficient use of limited resources and a higher likelihood of detecting sophisticated money laundering schemes.

Beyond AI/ML, other technological solutions that can bolster an entrepreneurial AML program include:

- Automated Identity Verification (IDV) tools: Streamline the Customer Due Diligence (CDD) process by instantly verifying customer identities against global databases, often integrating biometric recognition and document authentication.

- Sanctions Screening Software: Automatically check customer and transaction data against international sanctions lists (e.g., OFAC) to prevent dealings with designated individuals or entities.

- Transaction Monitoring Systems (TMS): Provide real-time or batch analysis of transactions, flagging anomalies based on predefined rules or advanced behavioral analytics.

- Case Management and Workflow Automation: Streamline the investigation and reporting process for suspicious activities, ensuring proper documentation and timely SAR filings.

These tools, once exclusively the domain of large financial institutions, are becoming more accessible and affordable for smaller businesses and startups. Cloud-based solutions, for instance, offer scalable and cost-effective ways to implement sophisticated AML technologies without the need for significant upfront infrastructure investment. The key for entrepreneurs is to select solutions that are proportionate to their risk profile and business size, providing maximum value without unnecessary complexity.

Future Trends and Adaptability

The future of AML compliance is characterized by continuous innovation and increasing data utilization. Trends such as:

- Digital Identity: The development of secure and verifiable digital identities could revolutionize CDD, making customer onboarding faster and more reliable.

- Blockchain and Distributed Ledger Technology (DLT): While blockchain assets present new AML challenges, the underlying technology could also offer solutions for transparent and secure record-keeping, potentially aiding in tracing illicit funds.

- Regulatory Technology (RegTech): The rise of RegTech solutions specifically designed to help businesses comply with regulatory requirements more efficiently, often leveraging AI and automation.

- Interagency Collaboration and Data Sharing: Increased efforts by regulatory bodies and financial institutions to share information and intelligence to combat financial crime more effectively.

For entrepreneurs, staying abreast of these emerging trends is not just about compliance; it’s about competitive advantage. Businesses that proactively adopt innovative AML solutions can offer faster, more secure services to their customers, build stronger relationships with banking partners, and differentiate themselves in a competitive market. The digital transformation of finance will inevitably bring new risks, but also new tools for mitigation. A forward-looking entrepreneur will view AML technology as an investment in the long-term security and integrity of their business, ensuring they remain resilient in the face of evolving financial crime threats and increasingly stringent regulatory expectations.

Building a Culture of Compliance

Beyond policies, technology, and procedures, the most significant long-term asset for an entrepreneur’s Anti-Money Laundering (AML) program is a deeply embedded culture of compliance. This goes beyond mere adherence to rules; it signifies that every individual within the organization understands the importance of AML, takes personal responsibility for their role in preventing financial crime, and views compliance as a core value rather than just a regulatory burden. A strong compliance culture acts as an early warning system, mitigating risks even before they escalate into formal violations.

For entrepreneurs, fostering such a culture starts at the top. Leadership must visibly and consistently champion compliance, demonstrating that it is a priority alongside revenue generation and growth. When the entrepreneur himself or herself emphasizes ethical conduct and regulatory adherence, it sets the tone for the entire team. This commitment is reflected in resource allocation for training, technology, and personnel dedicated to AML, signaling that this area is taken seriously and not merely an afterthought.

Key elements in cultivating a robust compliance culture include:

- Tone at the Top: Leaders actively promoting ethical behavior and regulatory adherence, making it clear that shortcuts are unacceptable.

- Clear Communication: Regularly communicating AML policies, procedures, and updates to all employees in an understandable and accessible manner.

- Training and Education: Providing continuous, relevant training that not only covers procedures but also explains the “why” behind AML rules, linking them to real-world impacts.

- Incentives and Disincentives: Recognizing and rewarding employees who demonstrate strong compliance behavior, and clearly outlining consequences for non-compliance.

- Reporting Mechanisms: Establishing easily accessible and trusted channels for employees to report concerns or suspicious activities without fear of retaliation.

Empowering employees is crucial. They should feel confident in questioning unusual transactions, escalating concerns, and proposing improvements to AML processes. This requires creating a safe environment where compliance questions are encouraged and compliance-related errors are viewed as learning opportunities, not immediate grounds for punishment. When employees understand their role in protecting the business and society from illicit finance, they become active participants in the AML defense, rather than passive implementers of rules.

Continuous Improvement and Adaptation

A strong compliance culture also embraces continuous improvement. The financial crime landscape is ever-changing, with new typologies and technologies emerging constantly. A healthy AML culture encourages:

- Feedback Loops: Systematically collecting feedback from employees on what works and what doesn’t in the AML program.

- Regular Reviews: Periodically reassessing risks and the effectiveness of controls, not just because it’s mandated, but because it’s a sound business practice.

- Benchmarking: Looking at industry best practices and learning from the compliance successes and failures of peers and larger institutions.

- Adaptability: Being nimble enough to adjust policies and procedures in response to new risks, regulatory changes, or technological advancements.

For entrepreneurs, this adaptability is a significant strength. They often have the agility that larger, more bureaucratic organizations lack. By embedding AML into the core values and daily operations, entrepreneurs can build a resilient business that not only meets its regulatory obligations but also actively contributes to the integrity of the financial system. This proactive stance protects the business from immediate threats and enhances its reputation in the long run, attracting ethical partners and customers. Ultimately, a strong culture of compliance is the most sustainable and powerful defense against the evolving challenges of financial crime, becoming a true competitive advantage in the modern business world.

| Key Point | Brief Description |

|---|---|

| 🛡️ Risk Mitigation | A robust AML program protects entrepreneurs from financial crime, legal liabilities, and reputational damage. |

| 📝 Core Elements | Includes internal controls, a compliance officer, ongoing training, and independent reviews. |

| 🔎 Due Diligence | Knowing your customer (KYC) and applying Enhanced Due Diligence (EDD) for higher-risk clients is crucial. |

| ⚙️ Tech & Culture | Leveraging tech solutions like AI/ML and fostering a compliance culture are vital for future-proofing AML. |

Frequently Asked Questions About AML Programs

AML refers to the laws, regulations, and procedures designed to prevent criminals from disguising illegally obtained funds as legitimate income. For entrepreneurs, it’s vital as it protects their business’s reputation, prevents legal penalties, and ensures they don’t inadvertently facilitate illicit activities. Compliance aids in maintaining trust with financial institutions and customers, fostering sustainable growth.

While strict AML regulations primarily target financial institutions, their scope is expanding. Entrepreneurs in certain high-risk sectors, those handling significant cash transactions, or those engaged in international business may directly or indirectly fall under AML scrutiny. Even if not directly regulated, having a basic AML framework can protect against financial crime and facilitate banking relationships.

An effective AML program typically includes a written risk assessment, the appointment of a compliance officer (even if it’s the owner), robust customer identification and due diligence (KYC), ongoing transaction monitoring, employee training, and periodic independent reviews. These components work together to detect and prevent money laundering.

Technology significantly boosts AML efforts by automating tasks like identity verification, sanctions screening, and transaction monitoring. AI and Machine Learning can analyze vast data to detect complex patterns, reducing manual effort and improving accuracy. Cloud-based solutions make these advanced tools accessible and affordable for smaller businesses, streamlining compliance operations efficiently.

Non-compliance can lead to severe consequences for entrepreneurs, including substantial financial penalties, legal prosecution for individuals, asset forfeiture, and significant reputational damage. It can also result in the termination of banking relationships, making it difficult to conduct legitimate business and severely impacting the long-term viability and growth of the venture.

Conclusion

For entrepreneurs navigating the intricate landscape of modern business, understanding and implementing a robust Anti-Money Laundering (AML) program transcends regulatory mandates; it becomes a fundamental pillar of sustainable growth and risk mitigation. This comprehensive journey from appreciating the evolving threats of financial crime to leveraging cutting-edge technological solutions, and ultimately, building a deep-seated culture of compliance, underscores that AML is not a monolithic burden but an integrated, dynamic safeguard. By proactively establishing tailored AML frameworks, entrepreneurs protect their hard-earned assets against illicit financial activities, foster trust with stakeholders, and secure their business’s future against an ever-changing risk environment. The investment in AML is an investment in integrity, resilience, and long-term success.