How to Secure Seed Funding for Your AI Startup in the US

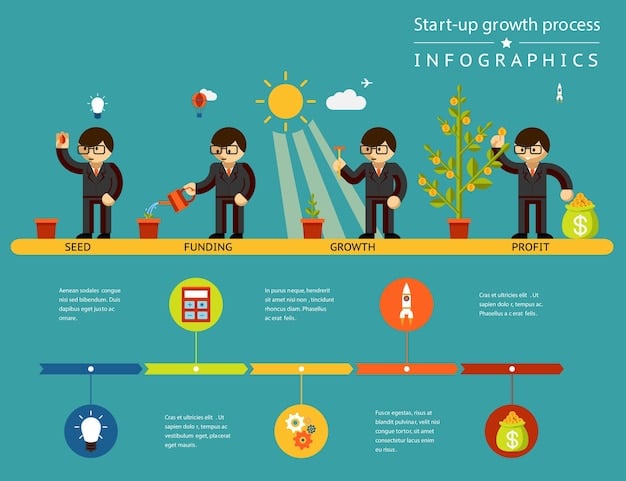

How to secure seed funding for your US-based AI startup in the current climate requires a strategic approach, focusing on understanding investor priorities, building a strong network, and presenting a compelling vision. This involves showcasing a clear path to profitability and demonstrating a deep understanding of the AI landscape.

Securing seed funding is a critical first step for any startup, especially in the rapidly evolving field of Artificial Intelligence. But how to secure seed funding for your US-based AI startup in the current climate? With increasing competition and shifting investor priorities, it’s more important than ever to understand the nuances of the funding landscape.

This article provides a comprehensive guide to help you navigate the challenges and opportunities in securing seed funding for your AI venture, offering actionable strategies and insights to increase your chances of success in the US market. Understanding how to secure seed funding for your US-based AI startup in the current climate involves more than just a great idea; it requires a solid plan and a strategic approach.

Understanding the Current AI Funding Climate in the US

The AI funding landscape in the US is dynamic and competitive. Understanding the current trends, investor preferences, and challenges is crucial for how to secure seed funding for your US-based AI startup in the current climate. Startups need to showcase not only innovative ideas but also a clear understanding of the market and a solid business plan.

Key Trends in AI Investment

AI is revolutionizing various sectors, leading to increased investment. However, investors are becoming more selective, focusing on startups with strong potential for scalability and real-world impact. Knowing where the smart money is going can inform your funding strategy and help you position your company to attract the right partners.

- Focus on Specific Applications: General AI solutions are less attractive than AI applied to specific industry problems.

- Emphasis on Data Quality: Startups with access to high-quality, relevant data are more likely to secure funding.

- Rise of Ethical AI: Investors are increasingly concerned with the ethical implications of AI, favoring companies with responsible AI practices.

Challenges in Securing Seed Funding

Despite the growing interest in AI, securing seed funding can be challenging. Many startups struggle to differentiate themselves and demonstrate a clear path to profitability. Overcoming these challenges requires a well-thought-out strategy and a compelling pitch. These are the most common challenges:

- Competition: The AI startup ecosystem is highly competitive, making it difficult to stand out.

- High Capital Requirements: Developing AI solutions often requires significant upfront investment.

- Investor Skepticism: Some investors are hesitant to invest in AI due to concerns about hype and long-term viability.

In the AI world, understanding evolving trends, competition, and a clear plan for profitability help you cut through the noise. By addressing these challenges head-on and highlighting what makes your AI startup unique, you’ll improve your chances of securing the seed funding you need to launch and grow your business

Building a Strong Foundation for Funding

Before approaching investors, it’s essential to build a solid foundation for your AI startup. This includes developing a clear value proposition, assembling a talented team, and creating a detailed business plan. Laying this groundwork can make all the difference when you’re trying to convince potential investors how to secure seed funding for your US-based AI startup in the current climate.

Crafting a Compelling Value Proposition

Your value proposition is the core of your startup’s identity, explaining how your AI solution solves a specific problem. The potential and value of the underlying model is key, but so is its practical application and monetization strategy. A great value proposition is:

- Concise and easy to understand

- Highlights the benefits of your AI solution

- Differentiates you from competitors

Assembling a Talented Team

Investors look for a team with the right mix of technical expertise and business acumen. Attracting and retaining top talent is crucial for building a successful AI startup. Don’t forget to build a team consisting of both technical and managerial skillsets.

- Technical Expertise: AI specialists, data scientists, and software engineers.

- Business Acumen: Experienced entrepreneurs, marketing professionals, and financial experts.

- Advisory Board: Industry leaders and experienced investors who can provide guidance and support.

Creating a Detailed Business Plan

A well-structured business plan is essential for attracting seed funding. It should include a market analysis, financial projections, and a clear roadmap for growth. Showcasing you’ve looked into market analysis and financial projections will help you stand out in the long run.

- Market Analysis: Identify your target market and assess the competitive landscape.

- Financial Projections: Develop realistic revenue forecasts and expense budgets.

- Roadmap for Growth: Outline your plans for scaling your business and achieving long-term profitability.

Establishing a solid foundation for your AI startup is essential for attracting seed funding. By crafting a compelling value proposition, assembling a talented team, and creating a detailed business plan, you can demonstrate to investors that your startup has the potential for success.

Identifying the Right Investors

Identifying the right investors is a critical step in securing seed funding for your AI startup. Different investors have different investment strategies and preferences. Targeting investors who align with your startup’s goals and vision can significantly increase your chances of success. Therefore, how to secure seed funding for your US-based AI startup in the current climate also entails identifying the investor that best suits your company.

Types of Seed Investors

Several types of investors can provide seed funding for AI startups, each with its own advantages and disadvantages.

- Angel Investors: High-net-worth individuals who invest in early-stage startups.

- Venture Capital Firms: Firms that invest in startups with high growth potential.

- Corporate Venture Capital: Investments from established companies looking to innovate.

Researching Potential Investors

Before reaching out to investors, it’s essential to do your homework. Research their investment history, portfolio companies, and areas of interest to determine if they are a good fit for your startup.

- Investment History: Review their past investments to see if they have experience in AI or related industries.

- Portfolio Companies: Examine their existing portfolio to identify potential synergies or conflicts of interest.

- Areas of Interest: Determine if their investment focus aligns with your startup’s goals and vision.

Networking and Building Relationships

Building relationships with investors before you need funding can be highly beneficial. Attend industry events, join relevant organizations, and leverage your network to connect with potential investors. Word of mouth can be quite helpful towards building relationships and awareness of your brand.

- Industry Events: Participate in conferences, workshops, and pitch competitions.

- Relevant Organizations: Join AI-focused groups and associations.

- Leverage Your Network: Ask for introductions to potential investors from your existing contacts.

Identifying the right investors is a critical step in learning how to secure seed funding for your US-based AI startup in the current climate. By understanding the different types of seed investors, researching potential investors, and networking to build relationships, you can increase your chances of finding the right partners for your startup.

Crafting a Winning Pitch Deck

Your pitch deck is your first opportunity to make a strong impression on investors. It should be clear, concise, and compelling, highlighting the key aspects of your AI startup. A well-crafted pitch deck can capture investors’ attention and persuade them to learn more. Presenting yourself in a professional manner is key when pursuing how to secure seed funding for your US-based AI startup in the current climate.

Essential Elements of a Pitch Deck

A successful pitch deck typically includes the following elements:

- Problem: Clearly define the problem your AI solution addresses.

- Solution: Explain how your AI solution solves the problem effectively.

- Market: Present your target market and market opportunity.

Highlighting Your Competitive Advantage

Investors want to know what makes your AI startup unique. Highlight your competitive advantages, such as proprietary technology, unique data assets, or a strong team.

- Proprietary Technology: Showcase any innovative algorithms or models you have developed.

- Unique Data Assets: Emphasize any exclusive data you have access to.

- Strong Team: Highlight the expertise and experience of your team members.

Demonstrating Traction and Potential

Investors are looking for evidence that your AI startup has the potential for success. Provide data and metrics to demonstrate traction and future growth potential.

- Traction: Show any early customer adoption, pilot programs, or revenue generation.

- Potential: Present realistic financial projections and growth forecasts.

- Milestones: Outline key milestones you plan to achieve with the seed funding.

Crafting a winning pitch deck is essential for securing seed funding for your AI startup. By including all the essential elements, highlighting your competitive advantage, and demonstrating traction and potential, you can create a compelling presentation that resonates with investors.

Navigating the Due Diligence Process

Once an investor expresses interest in your AI startup, they will conduct due diligence to verify the information you have provided. Prepare for the due diligence process by organizing your documents and being transparent about your startup’s strengths and weaknesses. When learning how to secure seed funding for your US-based AI startup in the current climate, understanding the due diligence process is a key part.

Preparing Your Documents

Investors will typically request a variety of documents, including:

- Financial Statements: Income statements, balance sheets, and cash flow statements.

- Legal Documents: Incorporation documents, contracts, and intellectual property filings.

- Business Plan: Your detailed business plan, including market analysis and financial projections.

Being Transparent and Open

Transparency is critical during the due diligence process. Be honest about your startup’s challenges and risks, and provide investors with all the information they need to make an informed decision.

- Disclose Any Risks: Be upfront about potential challenges your startup may face.

- Answer Questions Honestly: Provide clear and accurate responses to investor inquiries.

- Seek Legal Advice: Consult with an attorney to ensure you are compliant with all legal requirements.

Negotiating the Terms

Once the due diligence process is complete, you will need to negotiate the terms of the investment. Seek advice from experienced legal and financial professionals to ensure you get a fair deal.

- Valuation: Determine a fair valuation for your startup.

- Equity: Negotiate the amount of equity you are willing to give up.

- Control: Consider the level of control investors will have over your startup.

Navigating the due diligence process is a critical step in securing seed funding for your AI startup. By preparing your documents, being transparent and open, and negotiating the terms effectively, you can successfully complete the due diligence process and secure the funding you need to grow your business.

| Key Point | Brief Description |

|---|---|

| 💡 Value Proposition | Clearly define how your AI solves problems. |

| 🏢 Team Building | Assemble experts in AI, data, and business. |

| 📊 Market Analysis | Know your market size, competitors, and trends. |

| 🤝 Networking | Build relationships with potential investors beforehand. |

Frequently Asked Questions

Focus on a niche application, demonstrate a clear competitive advantage, and present a strong team. Highlighting real-world traction and ethical AI practices can also distinguish your startup.

Common mistakes include having an unclear value proposition, lacking a detailed business plan, and failing to demonstrate market traction. Overpromising and underdelivering can also deter investors.

The best type depends on your specific needs and goals. Angel investors offer flexibility, venture capital firms provide larger investments, and corporate venture capital can bring strategic partnerships and can help how to secure seed funding for your US-based AI startup in the current climate.

A strong advisory board can provide valuable guidance, credibility, and networking opportunities. Investors often view a well-connected advisory board as a sign of a promising startup. Your board should consist of experts.

Sectors like healthcare, finance, cybersecurity, and autonomous vehicles are currently attracting significant seed funding. These sectors offer high-growth potential, and investors see clear opportunities for AI-driven innovation.

Conclusion

Securing seed funding for your US-based AI startup in today’s climate requires a strategic and well-prepared approach. By understanding the current funding landscape, building a strong foundation, and crafting a compelling pitch, you can increase your chances of success. Continual adaptation of your strategy is the best way how to secure seed funding for your US-based AI startup in the current climate.

Remember, securing seed funding is just the beginning. Stay focused on building a successful AI startup that delivers real value to customers and makes a positive impact on the world. Good luck!